The five minerals identified as strategic in Malaysia’s plan are non-radioactive rare earth elements, bauxite, tin ore, silica sand and kaolin. — Reuters pic

KUALA LUMPUR, Aug 2 — With climate change and decarbonisation at the forefront of the global agenda, rare earth elements have taken centre stage in the move to a more sustainable future.

This group of 17 elements are critical components in clean energy technologies and products central to decarbonisation.

Projections from the International Energy Agency indicate that the rush for more clean energy applications and demand for electric vehicles and their batteries have driven up the demand for these critical minerals.

And Malaysia is well-placed to capitalise on this increased demand.

Demand to overtake supply

Although supply is projected to remain steady for the next five to seven years, demand is projected to overtake supply in the longer term.

A large portion of the world’s rare earths elements are located in areas which make them too expensive to mine, such as in oceans, and thus the concern over supply.

This is a boon for developing countries which are resource-rich in these critical minerals and are therefore keen to seize the increase in demand to join emerging new supply chains and to use these mineral resources to finance development.

It is therefore not surprising that interest in mining activities in Malaysia, which was once famous for tin exports, has revived in line with the rise in global interest.

Malaysia’s National Mineral Industry Transformation Plan 2021-2030 launched in 2021, aims to develop the national mineral industry sustainably along the entire value chain as a new source of growth for the country.

It has mapped mineral resources across the country including metallic minerals such as copper, tin, iron, manganese and gold and non-metallic minerals which include diamond, dolomite, gypsum, mica, amethyst and quartz. These minerals have an extensive presence in every state of Malaysia.

The plan revealed that Malaysia has a total of RM4.11 trillion worth of mineral resources, including RM745 billion ringgit worth of rare earths. The estimated value of metallic minerals alone is RM1.03 trillion.

Metallic minerals such as nickel, manganese, copper, and aluminium are used in EV battery production. Rare earth elements are used in the development of magnets that form the main propulsion motors in EVs.

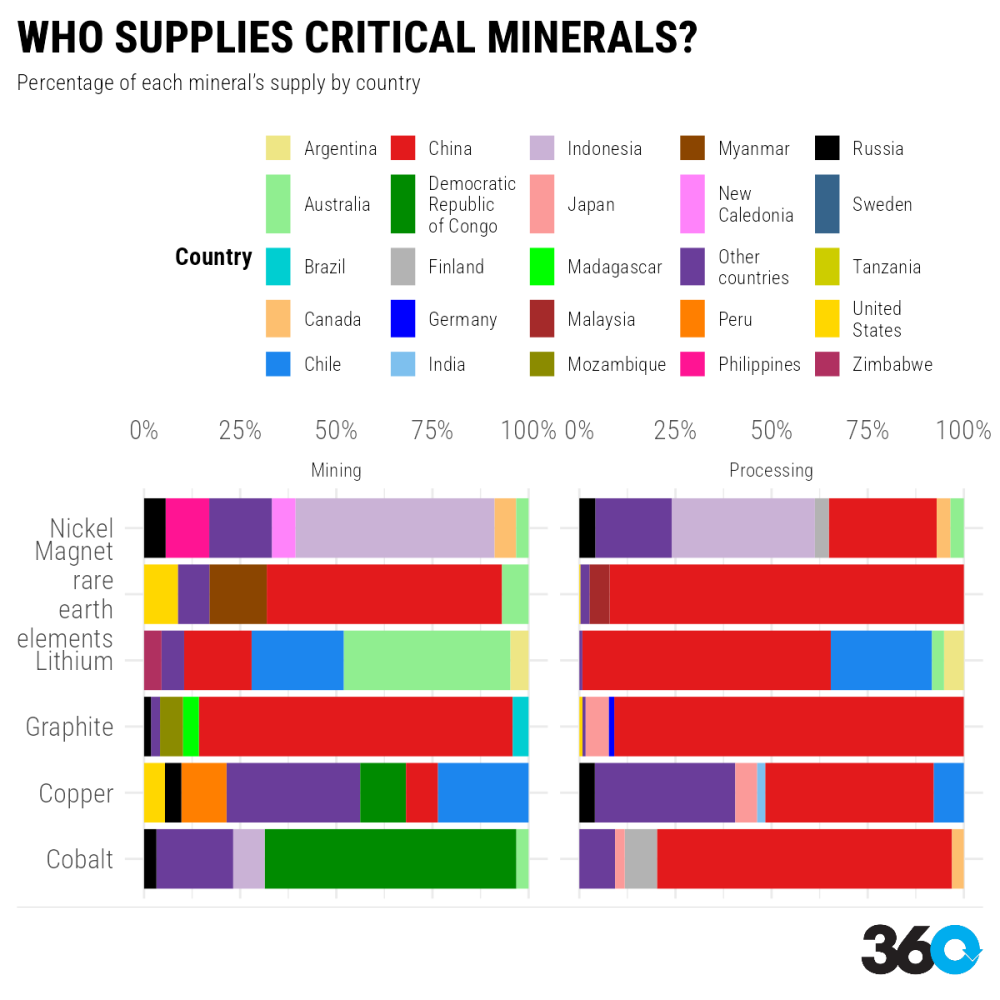

Supply of critical minerals and rare earth elements comes only from a few countries.

The five minerals identified as strategic in Malaysia’s plan are non-radioactive rare earth elements, bauxite, tin ore, silica sand and kaolin.

Of the five, non-radioactive rare earth elements have the highest estimated value. Hence, the focus is on tapping this mineral to help aid national development goals.

In 2014, the Malaysian Academy of Science together with the Ministry of Science, Technology, and Innovation suggested a blueprint for the establishment of a rare earth elements industry in the country as a new source of growth.

More than just mining

A critical component of this plan was the development of midstream and downstream activities — rather than a mere focus on mining alone — as this will increase related value-adding activities in the country.

Midstream refers to the transformation of minerals into refined products through separation and purification while downstream activities use these refined products in manufacturing such as EV batteries, smartphones, televisions and computers.

The suggested blueprint was not adopted, and the government came up with the National Mineral Industry Transformation Plan.

Like the blueprint, the plan emphasised that mining activities should not only be upstream-focused but also take into consideration downstream activity development as the way forward in mineral resource exploitation.

The country’s New Industrial Master Plan 2030 launched in September 2023 also calls for downstream development by using mineral resources to manufacture advanced materials, although what types of advanced materials are left to be determined by market players.

Advanced materials are used in technology applications including camcorders, aircraft, spacecraft, computers and fibre optics.

The Malaysian Investment Development Authority is courting foreign direct investment for the downstream development of the rare earths elements industry.

The government, meanwhile, imposed a moratorium on the export of unprocessed rare earth minerals in January.

The duration of the moratorium is not known and whether this will eventually lead to an export ban of unprocessed rare earth minerals is a matter of speculation.

Critical minerals-based development is not without its challenges.As noted by the International Energy Agency, local and regional development can be affected by even small-scale mineral development.

The first challenge is the use of the land where the unmined minerals are located. Deforestation is a key concern in the exploitation of these minerals. For example, the surge in nickel mining in Indonesia since 2019 has led to a loss of 76,301 hectares of forests — the size of New York City — escalating the destruction of biodiversity and habitats of some endangered species.

The forest conundrum

The locations of rare earth elements in Malaysia are near or in forests which are high-carbon stock areas. High concentrations of carbon contained in forests play a critical role in mitigating climate change as they absorb and store huge volumes of carbon dioxide from the atmosphere.

Malaysia is proposing to use in-situ leaching for rare earths mining as it will be less environmentally damaging since there is minimal soil excavation.

However, there is still a possibility that continuous chemical use can contaminate underground water resources or nearby rivers.

Studies on the impact of in-situ leaching practices in China since the late 1960s have shown that there is pollution of surface water in mining areas.

Nevertheless, the Malaysian Department of Minerals and Geoscience said in October last year that its findings from an in-situ leaching pilot project for the mining of non-radioactive rare earth elements in Perak avoided contamination.

It remains to be seen if the findings of one pilot project upends the evidence available from China’s experience in using this method.

Who pays the rent

Mineral rents can be a useful source of income for fostering development.

These are payments made to governments for the extraction of minerals within their borders. Perak, for example, was reported to have received RM1.66 million in royalty payments from the production of rare earth carbonates from its pilot project.

The mineral was exported to China after the royalty amount was paid by the project developer. The prospect of making a quick buck from selling rare earth elements has led to reports of illegal mining in Negeri Sembilan.

Unfortunately, there is no public disclosure on the mechanisms for royalty payments except when there is a query in parliament. Neither is there any disclosure on the division of mineral royalty payments between the Malaysian federal and state governments.

For natural resources, which are limited in supply, the conversion of this type of natural capital into physical capital that can drive development is critical but the road towards capturing mineral rents for this use is riddled with governance issues including political integrity, data disclosure, taxation frameworks and economic priorities.

It is not realistic to expect countries and mining companies to abandon the exploitation of mineral resources.

A more balanced approach is to make the development of these resources and their continued exploitation subject to better governance, transparency and accountability at the state, national and global levels.

* Professor Tham Siew Yean is a visiting senior fellow at the ISEAS-Yusof Ishak Institute, Singapore and Emeritus Professor at Universiti Kebangsaan Malaysia and Neo Hui Yun Rebecca is a research officer at the ISEAS-Yusof Ishak Institute.

** This article was first published in 360info.

*** This is the personal opinion of the writer or publication and does not necessarily represent the views of Malay Mail.